Global Prostatic Arterial Embolization (PAE) Market Overview

Western Market Research estimates that the Global Prostatic Arterial Embolization (PAE) Market was valued at USD XXXX million in 2025 and is projected to reach USD XXXX million by 2036, expanding at a CAGR of XX% during the forecast period 2026–2036.

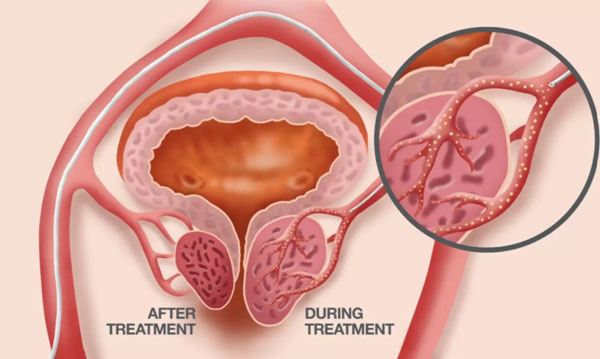

PAE is a minimally invasive, image-guided procedure used to treat benign prostatic hyperplasia (BPH) by selectively embolizing prostatic arteries to reduce gland volume and urinary symptoms. The market is gaining traction as an alternative to surgical interventions due to lower complication rates, shorter recovery times, and preservation of sexual function. Growth is supported by an aging male population, rising BPH prevalence, advances in interventional radiology, and expanding outpatient care pathways.

This study integrates primary research (interventional radiologists, urologists, device manufacturers, hospital procurement teams) with secondary analysis (clinical guidelines, regulatory pathways, historical utilization). The assessment evaluates device innovation, procedural adoption, reimbursement dynamics, training ecosystems, and regional access.

Impact of COVID-19 on the PAE Market

The pandemic temporarily reduced elective procedures and delayed patient consultations. However, recovery was driven by:

-

Backlog of deferred BPH treatments

-

Preference for minimally invasive and outpatient procedures

-

Faster return to care via ambulatory settings

Post-pandemic, PAE utilization rebounded with sustained interest from hospitals and specialty clinics.

Global PAE Market Segmentation

By Device & Consumables

-

Guidewires

-

Microcatheters

-

Embolic Microspheres

-

Sheaths & Accessory Devices

By Procedure Component

-

Diagnostic Angiography

-

Selective Prostatic Artery Catheterization

-

Embolization & Post-Procedure Imaging

By Application / Care Setting

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

By End User

-

Interventional Radiology Departments

-

Urology Centers

-

Academic & Training Hospitals

Regional Analysis

North America

-

Early adoption supported by interventional radiology expertise

-

Growing payer awareness and selective reimbursement

-

Strong demand from academic and tertiary hospitals

Europe

-

Increasing acceptance in public healthcare systems

-

Clinical evidence supporting long-term outcomes

-

Adoption across hospitals and specialty clinics

Asia-Pacific

-

Fastest-growing regional market

-

Expanding interventional radiology infrastructure

-

Rising BPH prevalence with aging demographics

South America

-

Gradual adoption in private healthcare settings

-

Increasing training initiatives and device availability

Middle East & Africa

-

Growth led by private hospitals and medical tourism hubs

-

Expanding access to minimally invasive urology care

Competitive Landscape – Key Market Players

Competition centers on device performance, imaging integration, physician training, and procedural support. Key players include:

-

Merit Medical Systems

-

Boston Scientific

-

Mentice

-

Siemens Healthineers

-

Terumo

-

GE HealthCare

-

Cook Medical

-

Medtronic

-

BD

-

Penumbra

Porter’s Five Forces Analysis

-

Threat of New Entrants: Medium – regulatory clearance and clinical evidence required

-

Bargaining Power of Suppliers: Moderate – specialized devices and microspheres

-

Bargaining Power of Buyers: Medium to High – hospital value analysis committees

-

Threat of Substitutes: Moderate – TURP and laser therapies

-

Competitive Rivalry: High – device differentiation and training support are key

SWOT Analysis

Strengths

-

Minimally invasive with favorable safety profile

-

Short recovery and outpatient suitability

-

Growing clinical evidence base

Weaknesses

-

Steep learning curve for operators

-

Variable reimbursement across regions

Opportunities

-

Expansion into ambulatory settings

-

Improved embolic materials and imaging guidance

-

Rising demand from aging populations

Threats

-

Competition from evolving surgical techniques

-

Reimbursement uncertainty in some markets

Trend Analysis

-

Increasing adoption of outpatient PAE

-

Development of smaller, trackable microcatheters

-

Advanced imaging and navigation for artery selection

-

Growth of simulation-based physician training

-

Standardization of clinical protocols and patient selection

Market Drivers & Challenges

Key Drivers

-

Rising BPH prevalence and aging male population

-

Patient preference for minimally invasive options

-

Technological advances in embolization devices

Key Challenges

-

Reimbursement variability

-

Need for specialized training and expertise

-

Awareness gaps among referring physicians

Value Chain Analysis

-

Raw Material & Component Suppliers

-

Device & Embolic Manufacturers

-

Imaging & Navigation Technology Providers

-

Hospitals, ASCs & Specialty Clinics

-

Patients & Post-Procedure Follow-Up Care

Strategic Recommendations for Stakeholders

-

Device Manufacturers: Invest in next-generation microcatheters and embolics

-

Hospitals & ASCs: Develop dedicated PAE programs with trained teams

-

Physicians: Expand referral education and patient awareness

-

Investors: Focus on Asia-Pacific growth and outpatient adoption

-

Policy Makers & Payers: Establish clear reimbursement pathways based on outcomes

1. Market Overview of Prostatic Arterial Embolization (PAE)

1.1 Prostatic Arterial Embolization (PAE) Market Overview

1.1.1 Prostatic Arterial Embolization (PAE) Product Scope

1.1.2 Market Status and Outlook

1.2 Prostatic Arterial Embolization (PAE) Market Size by Regions: 2015 VS 2021 VS 2026

1.3 Prostatic Arterial Embolization (PAE) Historic Market Size by Regions

1.4 Prostatic Arterial Embolization (PAE) Forecasted Market Size by Regions

1.5 Covid-19 Impact on Key Regions, Keyword Market Size YoY Growth

1.5.1 North America

1.5.2 East Asia

1.5.3 Europe

1.5.4 South Asia

1.5.5 Southeast Asia

1.5.6 Middle East

1.5.7 Africa

1.5.8 Oceania

1.5.9 South America

1.5.10 Rest of the World

1.6 Coronavirus Disease 2019 (Covid-19) Impact Will Have a Severe Impact on Global Growth

1.6.1 Covid-19 Impact: Global GDP Growth, 2019, 2020 and 2021 Projections

1.6.2 Covid-19 Impact: Commodity Prices Indices

1.6.3 Covid-19 Impact: Global Major Government Policy

2. Covid-19 Impact Prostatic Arterial Embolization (PAE) Sales Market by Type

2.1 Global Prostatic Arterial Embolization (PAE) Historic Market Size by Type

2.2 Global Prostatic Arterial Embolization (PAE) Forecasted Market Size by Type

2.3 Guidewires Implantation

2.4 Micro Catheters Implantation

2.5 Microspheres Implantation

3. Covid-19 Impact Prostatic Arterial Embolization (PAE) Sales Market by Application

3.1 Global Prostatic Arterial Embolization (PAE) Historic Market Size by Application

3.2 Global Prostatic Arterial Embolization (PAE) Forecasted Market Size by Application

3.3 Hospitals

3.4 Ambulatory Surgical Centers

3.5 Specialty Clinics

4. Covid-19 Impact Market Competition by Manufacturers

4.1 Global Prostatic Arterial Embolization (PAE) Production Capacity Market Share by Manufacturers

4.2 Global Prostatic Arterial Embolization (PAE) Revenue Market Share by Manufacturers

4.3 Global Prostatic Arterial Embolization (PAE) Average Price by Manufacturers

5. Company Profiles and Key Figures in Prostatic Arterial Embolization (PAE) Business

5.1 Merit Medical Systems

5.1.1 Merit Medical Systems Company Profile

5.1.2 Merit Medical Systems Prostatic Arterial Embolization (PAE) Product Specification

5.1.3 Merit Medical Systems Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

5.2 Boston Scientific

5.2.1 Boston Scientific Company Profile

5.2.2 Boston Scientific Prostatic Arterial Embolization (PAE) Product Specification

5.2.3 Boston Scientific Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

5.3 Mentice

5.3.1 Mentice Company Profile

5.3.2 Mentice Prostatic Arterial Embolization (PAE) Product Specification

5.3.3 Mentice Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

5.4 Siemens Healthineers

5.4.1 Siemens Healthineers Company Profile

5.4.2 Siemens Healthineers Prostatic Arterial Embolization (PAE) Product Specification

5.4.3 Siemens Healthineers Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

5.5 Terumo

5.5.1 Terumo Company Profile

5.5.2 Terumo Prostatic Arterial Embolization (PAE) Product Specification

5.5.3 Terumo Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

5.6 General Electric

5.6.1 General Electric Company Profile

5.6.2 General Electric Prostatic Arterial Embolization (PAE) Product Specification

5.6.3 General Electric Prostatic Arterial Embolization (PAE) Production Capacity, Revenue, Price and Gross Margin

6. North America

6.1 North America Prostatic Arterial Embolization (PAE) Market Size

6.2 North America Prostatic Arterial Embolization (PAE) Key Players in North America

6.3 North America Prostatic Arterial Embolization (PAE) Market Size by Type

6.4 North America Prostatic Arterial Embolization (PAE) Market Size by Application

7. East Asia

7.1 East Asia Prostatic Arterial Embolization (PAE) Market Size

7.2 East Asia Prostatic Arterial Embolization (PAE) Key Players in North America

7.3 East Asia Prostatic Arterial Embolization (PAE) Market Size by Type

7.4 East Asia Prostatic Arterial Embolization (PAE) Market Size by Application

8. Europe

8.1 Europe Prostatic Arterial Embolization (PAE) Market Size

8.2 Europe Prostatic Arterial Embolization (PAE) Key Players in North America

8.3 Europe Prostatic Arterial Embolization (PAE) Market Size by Type

8.4 Europe Prostatic Arterial Embolization (PAE) Market Size by Application

9. South Asia

9.1 South Asia Prostatic Arterial Embolization (PAE) Market Size

9.2 South Asia Prostatic Arterial Embolization (PAE) Key Players in North America

9.3 South Asia Prostatic Arterial Embolization (PAE) Market Size by Type

9.4 South Asia Prostatic Arterial Embolization (PAE) Market Size by Application

10. Southeast Asia

10.1 Southeast Asia Prostatic Arterial Embolization (PAE) Market Size

10.2 Southeast Asia Prostatic Arterial Embolization (PAE) Key Players in North America

10.3 Southeast Asia Prostatic Arterial Embolization (PAE) Market Size by Type

10.4 Southeast Asia Prostatic Arterial Embolization (PAE) Market Size by Application

11. Middle East

11.1 Middle East Prostatic Arterial Embolization (PAE) Market Size

11.2 Middle East Prostatic Arterial Embolization (PAE) Key Players in North America

11.3 Middle East Prostatic Arterial Embolization (PAE) Market Size by Type

11.4 Middle East Prostatic Arterial Embolization (PAE) Market Size by Application

12. Africa

12.1 Africa Prostatic Arterial Embolization (PAE) Market Size

12.2 Africa Prostatic Arterial Embolization (PAE) Key Players in North America

12.3 Africa Prostatic Arterial Embolization (PAE) Market Size by Type

12.4 Africa Prostatic Arterial Embolization (PAE) Market Size by Application

13. Oceania

13.1 Oceania Prostatic Arterial Embolization (PAE) Market Size

13.2 Oceania Prostatic Arterial Embolization (PAE) Key Players in North America

13.3 Oceania Prostatic Arterial Embolization (PAE) Market Size by Type

13.4 Oceania Prostatic Arterial Embolization (PAE) Market Size by Application

14. South America

14.1 South America Prostatic Arterial Embolization (PAE) Market Size

14.2 South America Prostatic Arterial Embolization (PAE) Key Players in North America

14.3 South America Prostatic Arterial Embolization (PAE) Market Size by Type

14.4 South America Prostatic Arterial Embolization (PAE) Market Size by Application

15. Rest of the World

15.1 Rest of the World Prostatic Arterial Embolization (PAE) Market Size

15.2 Rest of the World Prostatic Arterial Embolization (PAE) Key Players in North America

15.3 Rest of the World Prostatic Arterial Embolization (PAE) Market Size by Type

15.4 Rest of the World Prostatic Arterial Embolization (PAE) Market Size by Application

16 Prostatic Arterial Embolization (PAE) Market Dynamics

16.1 Covid-19 Impact Market Top Trends

16.2 Covid-19 Impact Market Drivers

16.3 Covid-19 Impact Market Challenges

16.4 Porter

Global PAE Market Segmentation

By Device & Consumables

-

Guidewires

-

Microcatheters

-

Embolic Microspheres

-

Sheaths & Accessory Devices

By Procedure Component

-

Diagnostic Angiography

-

Selective Prostatic Artery Catheterization

-

Embolization & Post-Procedure Imaging

By Application / Care Setting

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

By End User

-

Interventional Radiology Departments

-

Urology Centers

-

Academic & Training Hospitals