Global Scleral Lens Market Overview

Western Market Research estimates that the Global Scleral Lens Market was valued at USD XXXX million in 2025 and is expected to reach USD XXXX million by 2036, expanding at a CAGR of XX% during the forecast period 2026–2036.

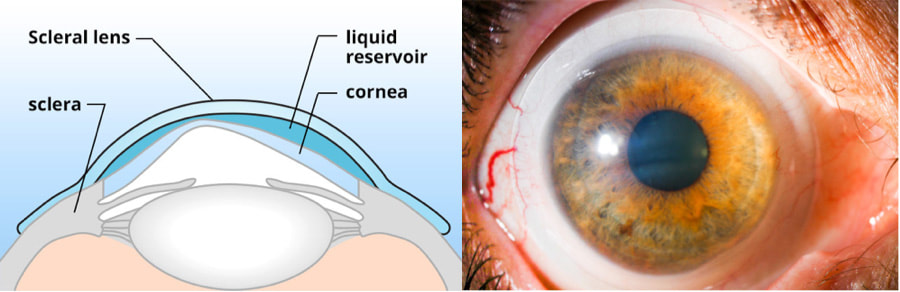

Scleral lenses are large-diameter rigid gas permeable (RGP) contact lenses designed to vault over the cornea and rest on the sclera. They create a fluid reservoir between the lens and the corneal surface, making them especially effective for irregular corneas, severe dry eye disease, keratoconus, post-surgical corneal conditions, and ocular surface disorders.

Market growth is being driven by rising prevalence of keratoconus and corneal ectasia, increasing diagnosis of ocular surface diseases, growing acceptance of specialty contact lenses, and continuous innovation in high oxygen-permeable materials and custom lens designs.

Impact of COVID-19 on the Scleral Lens Market

The COVID-19 pandemic caused a temporary slowdown in market growth due to reduced outpatient eye-care visits and deferred elective vision correction procedures. However, recovery was steady as clinics reopened and patient demand normalized.

Key pandemic-related observations include:

-

Short-term decline in new lens fittings

-

Increased focus on medical (therapeutic) indications over cosmetic use

-

Acceleration of digital fitting tools and tele-optometry support

Post-pandemic, the market returned to a growth trajectory supported by backlog demand and greater awareness of specialty vision care.

Global Scleral Lens Market Segmentation

By Product Type

-

Mini-Scleral Lenses

-

Semi-Scleral Lenses

-

Full Scleral Lenses

-

Customized & Hybrid Scleral Designs

By Material

-

High Oxygen-Permeable RGP Materials

-

Fluorosilicone Acrylate Materials

By Application

-

Hospitals

-

Eye Clinics & Specialty Ophthalmology Centers

-

Optical & Vision Care Centers

By Indication

-

Keratoconus & Corneal Ectasia

-

Post-Surgical Corneal Disorders

-

Severe Dry Eye Syndrome

-

Ocular Surface Disease

Regional Analysis

North America

-

Largest market due to high awareness of specialty contact lenses

-

Strong presence of trained optometrists and ophthalmologists

-

Favorable reimbursement for medically necessary lenses

Europe

-

Stable growth supported by advanced eye-care infrastructure

-

Increasing adoption of scleral lenses for therapeutic use

-

Strong regulatory and professional training standards

Asia-Pacific

-

Fastest-growing region

-

Rising diagnosis of corneal disorders

-

Expansion of specialty eye clinics and urban vision centers

South America

-

Moderate growth driven by improving access to ophthalmic care

-

Growing adoption in private eye clinics

Middle East & Africa

-

Gradual growth led by tertiary hospitals

-

Increasing medical tourism and specialty ophthalmology services

Competitive Landscape – Key Market Players

Competition is based on lens customization capability, material innovation, practitioner support, and global distribution reach.

Key players include:

-

Bausch Health

-

Novartis

-

The Cooper Companies

-

Johnson & Johnson Vision

-

EssilorLuxottica

-

ZEISS

-

Safilo Group

-

Rodenstock

-

Menicon

-

Contamac

-

AccuLens

-

SynergEyes

Porter’s Five Forces Analysis

-

Threat of New Entrants: Low – high expertise and customization requirements

-

Bargaining Power of Suppliers: Moderate – specialized lens materials

-

Bargaining Power of Buyers: Moderate – practitioner-driven purchasing

-

Threat of Substitutes: Low – limited alternatives for irregular corneas

-

Competitive Rivalry: Moderate – niche but innovation-driven market

SWOT Analysis

Strengths

-

Clinically proven for complex corneal conditions

-

High patient comfort and visual outcomes

-

Strong practitioner loyalty

Weaknesses

-

High cost compared to soft lenses

-

Requires specialized fitting expertise

Opportunities

-

Rising prevalence of keratoconus

-

Growth in therapeutic and medical lens applications

-

Technological advancements in customization

Threats

-

Limited trained practitioners in emerging markets

-

Reimbursement variability across regions

Trend Analysis

-

Rising adoption of mini-scleral and custom-designed lenses

-

Increased use for severe dry eye management

-

Integration of digital corneal mapping and CAD-based lens design

-

Growing practitioner education and certification programs

-

Expansion of scleral lenses beyond tertiary eye centers

Market Drivers & Challenges

Key Drivers

-

Increasing incidence of corneal irregularities

-

Growing awareness of specialty contact lenses

-

Advancements in lens materials and fitting technologies

Key Challenges

-

High fitting time and skill requirements

-

Cost constraints for patients

-

Limited reimbursement coverage in some regions

Value Chain Analysis

-

Raw Material & Polymer Development

-

Lens Design & Custom Manufacturing

-

Practitioner Fitting & Patient Assessment

-

Distribution to Clinics & Hospitals

-

Patient Use, Follow-up & Replacement

Strategic Recommendations for Stakeholders

-

Manufacturers: Invest in high-Dk materials and digital customization platforms

-

Eye Clinics: Expand specialty lens fitting capabilities

-

Investors: Target Asia-Pacific and therapeutic eye-care growth

-

Training Bodies: Increase scleral lens education programs

-

Policy Makers: Improve reimbursement frameworks for medical lenses

1. Market Overview of Scleral Lens

1.1 Scleral Lens Market Overview

1.1.1 Scleral Lens Product Scope

1.1.2 Market Status and Outlook

1.2 Scleral Lens Market Size by Regions: 2015 VS 2021 VS 2026

1.3 Scleral Lens Historic Market Size by Regions

1.4 Scleral Lens Forecasted Market Size by Regions

1.5 Covid-19 Impact on Key Regions, Keyword Market Size YoY Growth

1.5.1 North America

1.5.2 East Asia

1.5.3 Europe

1.5.4 South Asia

1.5.5 Southeast Asia

1.5.6 Middle East

1.5.7 Africa

1.5.8 Oceania

1.5.9 South America

1.5.10 Rest of the World

1.6 Coronavirus Disease 2019 (Covid-19) Impact Will Have a Severe Impact on Global Growth

1.6.1 Covid-19 Impact: Global GDP Growth, 2019, 2020 and 2021 Projections

1.6.2 Covid-19 Impact: Commodity Prices Indices

1.6.3 Covid-19 Impact: Global Major Government Policy

2. Covid-19 Impact Scleral Lens Sales Market by Type

2.1 Global Scleral Lens Historic Market Size by Type

2.2 Global Scleral Lens Forecasted Market Size by Type

2.3 Mini-Scleral Lenses

2.4 Full Scleral Lenses

2.5 Semi-Scleral Lenses

2.6 Others

3. Covid-19 Impact Scleral Lens Sales Market by Application

3.1 Global Scleral Lens Historic Market Size by Application

3.2 Global Scleral Lens Forecasted Market Size by Application

3.3 Hospital

3.4 Eye Clinic

3.5 Others

4. Covid-19 Impact Market Competition by Manufacturers

4.1 Global Scleral Lens Production Capacity Market Share by Manufacturers

4.2 Global Scleral Lens Revenue Market Share by Manufacturers

4.3 Global Scleral Lens Average Price by Manufacturers

5. Company Profiles and Key Figures in Scleral Lens Business

5.1 Bausch Health

5.1.1 Bausch Health Company Profile

5.1.2 Bausch Health Scleral Lens Product Specification

5.1.3 Bausch Health Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.2 Novartis

5.2.1 Novartis Company Profile

5.2.2 Novartis Scleral Lens Product Specification

5.2.3 Novartis Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.3 CooperCompanies

5.3.1 CooperCompanies Company Profile

5.3.2 CooperCompanies Scleral Lens Product Specification

5.3.3 CooperCompanies Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.4 Johnson & Johnson

5.4.1 Johnson & Johnson Company Profile

5.4.2 Johnson & Johnson Scleral Lens Product Specification

5.4.3 Johnson & Johnson Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.5 EssilorLuxottica

5.5.1 EssilorLuxottica Company Profile

5.5.2 EssilorLuxottica Scleral Lens Product Specification

5.5.3 EssilorLuxottica Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.6 ZEISS

5.6.1 ZEISS Company Profile

5.6.2 ZEISS Scleral Lens Product Specification

5.6.3 ZEISS Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.7 Safilo

5.7.1 Safilo Company Profile

5.7.2 Safilo Scleral Lens Product Specification

5.7.3 Safilo Scleral Lens Production Capacity, Revenue, Price and Gross Margin

5.8 Rodenstock

5.8.1 Rodenstock Company Profile

5.8.2 Rodenstock Scleral Lens Product Specification

5.8.3 Rodenstock Scleral Lens Production Capacity, Revenue, Price and Gross Margin

6. North America

6.1 North America Scleral Lens Market Size

6.2 North America Scleral Lens Key Players in North America

6.3 North America Scleral Lens Market Size by Type

6.4 North America Scleral Lens Market Size by Application

7. East Asia

7.1 East Asia Scleral Lens Market Size

7.2 East Asia Scleral Lens Key Players in North America

7.3 East Asia Scleral Lens Market Size by Type

7.4 East Asia Scleral Lens Market Size by Application

8. Europe

8.1 Europe Scleral Lens Market Size

8.2 Europe Scleral Lens Key Players in North America

8.3 Europe Scleral Lens Market Size by Type

8.4 Europe Scleral Lens Market Size by Application

9. South Asia

9.1 South Asia Scleral Lens Market Size

9.2 South Asia Scleral Lens Key Players in North America

9.3 South Asia Scleral Lens Market Size by Type

9.4 South Asia Scleral Lens Market Size by Application

10. Southeast Asia

10.1 Southeast Asia Scleral Lens Market Size

10.2 Southeast Asia Scleral Lens Key Players in North America

10.3 Southeast Asia Scleral Lens Market Size by Type

10.4 Southeast Asia Scleral Lens Market Size by Application

11. Middle East

11.1 Middle East Scleral Lens Market Size

11.2 Middle East Scleral Lens Key Players in North America

11.3 Middle East Scleral Lens Market Size by Type

11.4 Middle East Scleral Lens Market Size by Application

12. Africa

12.1 Africa Scleral Lens Market Size

12.2 Africa Scleral Lens Key Players in North America

12.3 Africa Scleral Lens Market Size by Type

12.4 Africa Scleral Lens Market Size by Application

13. Oceania

13.1 Oceania Scleral Lens Market Size

13.2 Oceania Scleral Lens Key Players in North America

13.3 Oceania Scleral Lens Market Size by Type

13.4 Oceania Scleral Lens Market Size by Application

14. South America

14.1 South America Scleral Lens Market Size

14.2 South America Scleral Lens Key Players in North America

14.3 South America Scleral Lens Market Size by Type

14.4 South America Scleral Lens Market Size by Application

15. Rest of the World

15.1 Rest of the World Scleral Lens Market Size

15.2 Rest of the World Scleral Lens Key Players in North America

15.3 Rest of the World Scleral Lens Market Size by Type

15.4 Rest of the World Scleral Lens Market Size by Application

16 Scleral Lens Market Dynamics

16.1 Covid-19 Impact Market Top Trends

16.2 Covid-19 Impact Market Drivers

16.3 Covid-19 Impact Market Challenges

16.4 Porter

Global Scleral Lens Market Segmentation

By Product Type

-

Mini-Scleral Lenses

-

Semi-Scleral Lenses

-

Full Scleral Lenses

-

Customized & Hybrid Scleral Designs

By Material

-

High Oxygen-Permeable RGP Materials

-

Fluorosilicone Acrylate Materials

By Application

-

Hospitals

-

Eye Clinics & Specialty Ophthalmology Centers

-

Optical & Vision Care Centers

By Indication

-

Keratoconus & Corneal Ectasia

-

Post-Surgical Corneal Disorders

-

Severe Dry Eye Syndrome

-

Ocular Surface Disease

Competitive Landscape – Key Market Players

Competition is based on lens customization capability, material innovation, practitioner support, and global distribution reach.

Key players include:

-

Bausch Health

-

Novartis

-

The Cooper Companies

-

Johnson & Johnson Vision

-

EssilorLuxottica

-

ZEISS

-

Safilo Group

-

Rodenstock

-

Menicon

-

Contamac

-

AccuLens

-

SynergEyes