Global Blood Purification Equipment Market Overview

Western Market Research estimates that the Global Blood Purification Equipment Market was valued at USD XXXX million in 2025 and is projected to reach USD XXXX million by 2036, expanding at a CAGR of XX% during the 2026–2036 forecast period.

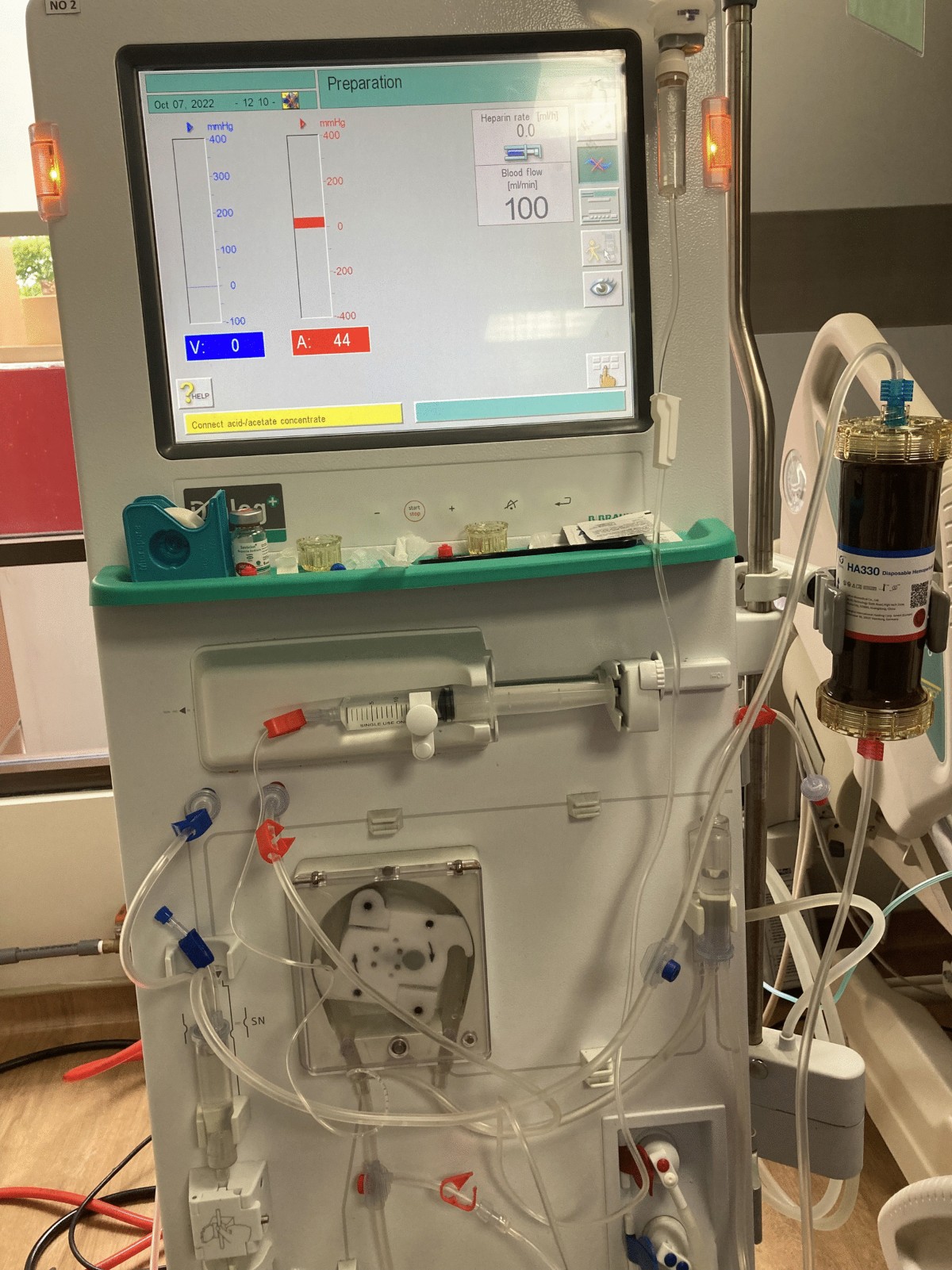

Blood purification equipment is widely used to remove toxins, metabolic waste, excess fluids, and inflammatory mediators from the bloodstream in patients suffering from renal failure, sepsis, autoimmune disorders, and critical illnesses. The market is driven by the rising global burden of chronic kidney disease (CKD), increasing ICU admissions, and rapid advancements in extracorporeal blood treatment technologies.

The COVID-19 pandemic had a notable positive impact on demand for blood purification systems. Severe COVID-19 cases often resulted in acute kidney injury (AKI), cytokine storm, and multi-organ failure, significantly increasing the use of:

-

Continuous renal replacement therapy (CRRT)

-

Hemoperfusion and adsorption devices

-

Emergency dialysis systems in ICUs

Temporary supply chain disruptions were observed; however, long-term adoption of advanced blood purification technologies accelerated across critical care settings.

Global Blood Purification Equipment Market Segmentation

By Product Type

-

Hemodialysis Devices

-

Blood Filtration Devices

-

Hemoperfusion Devices

-

Continuous Renal Replacement Therapy (CRRT) Systems

-

Plasma Exchange Equipment

By Technology

-

Diffusion-Based Purification

-

Convection-Based Purification

-

Adsorption-Based Purification

By Application

-

Hospitals

-

Medical Centers

-

Dialysis Centers

-

Intensive Care Units (ICUs)

-

Other Healthcare Facilities

By End User

-

Public Hospitals

-

Private Hospitals

-

Specialty Clinics

-

Home Dialysis Providers

Regional Analysis

North America

-

Largest market share driven by high CKD prevalence

-

Strong ICU infrastructure and reimbursement systems

-

Early adoption of CRRT and hemoperfusion technologies

Europe

-

Widespread use of advanced dialysis equipment

-

Strong regulatory emphasis on patient safety

-

Growth supported by aging population

Asia-Pacific

-

Fastest-growing regional market

-

Rising incidence of diabetes and hypertension

-

Rapid expansion of dialysis centers in China, India, and Southeast Asia

South America

-

Gradual growth supported by improving renal care access

-

Increasing government investment in hospital infrastructure

Middle East & Africa

-

Growth led by Gulf countries

-

Rising awareness of renal disease management

-

Expanding private healthcare sector

Competitive Landscape – Key Market Players

The market is moderately consolidated, with competition focused on technology innovation, device efficiency, membrane materials, and clinical performance.

Key players include:

-

Asahi Kasei Medical

-

B. Braun

-

Baxter

-

GE Healthcare

-

Jafron Biomedical

-

Bain Medical

-

Nipro Corporation

-

Fresenius Medical Care

-

Toray Medical

-

Medtronic

-

Guangzhou Enttex Medical Products Industry

-

Kawasumi Laboratories

Porter’s Five Forces Analysis

-

Threat of New Entrants: Low to Moderate (high regulatory and R&D barriers)

-

Bargaining Power of Suppliers: Moderate (specialized membranes and components)

-

Bargaining Power of Buyers: High (bulk hospital procurement)

-

Threat of Substitutes: Low (life-saving nature of therapy)

-

Competitive Rivalry: High (technology-driven differentiation)

SWOT Analysis

Strengths

-

Critical life-support role

-

Continuous technological innovation

-

Strong clinical acceptance

Weaknesses

-

High equipment and maintenance costs

-

Need for skilled operators

Opportunities

-

Expansion of home dialysis

-

Growth in sepsis and ICU therapies

-

Emerging markets with unmet renal care needs

Threats

-

Pricing pressure from healthcare payers

-

Stringent regulatory approvals

-

Supply chain volatility

Trend Analysis

-

Rising adoption of CRRT systems in ICUs

-

Growth of adsorption-based blood purification

-

Development of portable and home-use dialysis devices

-

Integration of AI-based monitoring systems

-

Increasing focus on biocompatible membranes

Market Drivers & Challenges

Key Drivers

-

Increasing prevalence of chronic kidney disease

-

Rising ICU admissions and critical care cases

-

Growing geriatric population

-

Technological advancements in dialysis and hemoperfusion

Key Challenges

-

High treatment and device costs

-

Limited access in low-income regions

-

Shortage of trained dialysis professionals

Value Chain Analysis

-

Raw Material & Membrane Manufacturing

-

Device Design & System Integration

-

Regulatory Approval & Clinical Validation

-

Distribution & Hospital Procurement

-

Clinical Use & Post-Sales Service

Strategic Recommendations for Stakeholders

-

Manufacturers: Focus on portable, CRRT, and adsorption-based systems

-

Hospitals: Invest in ICU-focused blood purification technologies

-

Investors: Target Asia-Pacific and critical care segments

-

Distributors: Offer bundled dialysis and consumables solutions

-

Policy Makers: Support renal care infrastructure expansion

1. Market Overview of Blood Purification Equipment

1.1 Blood Purification Equipment Market Overview

1.1.1 Blood Purification Equipment Product Scope

1.1.2 Market Status and Outlook

1.2 Blood Purification Equipment Market Size by Regions: 2015 VS 2021 VS 2026

1.3 Blood Purification Equipment Historic Market Size by Regions

1.4 Blood Purification Equipment Forecasted Market Size by Regions

1.5 Covid-19 Impact on Key Regions, Keyword Market Size YoY Growth

1.5.1 North America

1.5.2 East Asia

1.5.3 Europe

1.5.4 South Asia

1.5.5 Southeast Asia

1.5.6 Middle East

1.5.7 Africa

1.5.8 Oceania

1.5.9 South America

1.5.10 Rest of the World

1.6 Coronavirus Disease 2019 (Covid-19) Impact Will Have a Severe Impact on Global Growth

1.6.1 Covid-19 Impact: Global GDP Growth, 2019, 2020 and 2021 Projections

1.6.2 Covid-19 Impact: Commodity Prices Indices

1.6.3 Covid-19 Impact: Global Major Government Policy

2. Covid-19 Impact Blood Purification Equipment Sales Market by Type

2.1 Global Blood Purification Equipment Historic Market Size by Type

2.2 Global Blood Purification Equipment Forecasted Market Size by Type

2.3 Hemodialysis Device

2.4 Blood Filtration Device

2.5 Hemoperfusion Device

3. Covid-19 Impact Blood Purification Equipment Sales Market by Application

3.1 Global Blood Purification Equipment Historic Market Size by Application

3.2 Global Blood Purification Equipment Forecasted Market Size by Application

3.3 Hospital

3.4 Medical Center

3.5 Other

4. Covid-19 Impact Market Competition by Manufacturers

4.1 Global Blood Purification Equipment Production Capacity Market Share by Manufacturers

4.2 Global Blood Purification Equipment Revenue Market Share by Manufacturers

4.3 Global Blood Purification Equipment Average Price by Manufacturers

5. Company Profiles and Key Figures in Blood Purification Equipment Business

5.1 Asahi Kasei Medical

5.1.1 Asahi Kasei Medical Company Profile

5.1.2 Asahi Kasei Medical Blood Purification Equipment Product Specification

5.1.3 Asahi Kasei Medical Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.2 B.Braun

5.2.1 B.Braun Company Profile

5.2.2 B.Braun Blood Purification Equipment Product Specification

5.2.3 B.Braun Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.3 Baxter

5.3.1 Baxter Company Profile

5.3.2 Baxter Blood Purification Equipment Product Specification

5.3.3 Baxter Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.4 Jafron Biomedical Co

5.4.1 Jafron Biomedical Co Company Profile

5.4.2 Jafron Biomedical Co Blood Purification Equipment Product Specification

5.4.3 Jafron Biomedical Co Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.5 Bain Medical

5.5.1 Bain Medical Company Profile

5.5.2 Bain Medical Blood Purification Equipment Product Specification

5.5.3 Bain Medical Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.6 Guangzhou Enttex Medical Products Industry

5.6.1 Guangzhou Enttex Medical Products Industry Company Profile

5.6.2 Guangzhou Enttex Medical Products Industry Blood Purification Equipment Product Specification

5.6.3 Guangzhou Enttex Medical Products Industry Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

5.7 GE Healthcare

5.7.1 GE Healthcare Company Profile

5.7.2 GE Healthcare Blood Purification Equipment Product Specification

5.7.3 GE Healthcare Blood Purification Equipment Production Capacity, Revenue, Price and Gross Margin

6. North America

6.1 North America Blood Purification Equipment Market Size

6.2 North America Blood Purification Equipment Key Players in North America

6.3 North America Blood Purification Equipment Market Size by Type

6.4 North America Blood Purification Equipment Market Size by Application

7. East Asia

7.1 East Asia Blood Purification Equipment Market Size

7.2 East Asia Blood Purification Equipment Key Players in North America

7.3 East Asia Blood Purification Equipment Market Size by Type

7.4 East Asia Blood Purification Equipment Market Size by Application

8. Europe

8.1 Europe Blood Purification Equipment Market Size

8.2 Europe Blood Purification Equipment Key Players in North America

8.3 Europe Blood Purification Equipment Market Size by Type

8.4 Europe Blood Purification Equipment Market Size by Application

9. South Asia

9.1 South Asia Blood Purification Equipment Market Size

9.2 South Asia Blood Purification Equipment Key Players in North America

9.3 South Asia Blood Purification Equipment Market Size by Type

9.4 South Asia Blood Purification Equipment Market Size by Application

10. Southeast Asia

10.1 Southeast Asia Blood Purification Equipment Market Size

10.2 Southeast Asia Blood Purification Equipment Key Players in North America

10.3 Southeast Asia Blood Purification Equipment Market Size by Type

10.4 Southeast Asia Blood Purification Equipment Market Size by Application

11. Middle East

11.1 Middle East Blood Purification Equipment Market Size

11.2 Middle East Blood Purification Equipment Key Players in North America

11.3 Middle East Blood Purification Equipment Market Size by Type

11.4 Middle East Blood Purification Equipment Market Size by Application

12. Africa

12.1 Africa Blood Purification Equipment Market Size

12.2 Africa Blood Purification Equipment Key Players in North America

12.3 Africa Blood Purification Equipment Market Size by Type

12.4 Africa Blood Purification Equipment Market Size by Application

13. Oceania

13.1 Oceania Blood Purification Equipment Market Size

13.2 Oceania Blood Purification Equipment Key Players in North America

13.3 Oceania Blood Purification Equipment Market Size by Type

13.4 Oceania Blood Purification Equipment Market Size by Application

14. South America

14.1 South America Blood Purification Equipment Market Size

14.2 South America Blood Purification Equipment Key Players in North America

14.3 South America Blood Purification Equipment Market Size by Type

14.4 South America Blood Purification Equipment Market Size by Application

15. Rest of the World

15.1 Rest of the World Blood Purification Equipment Market Size

15.2 Rest of the World Blood Purification Equipment Key Players in North America

15.3 Rest of the World Blood Purification Equipment Market Size by Type

15.4 Rest of the World Blood Purification Equipment Market Size by Application

16 Blood Purification Equipment Market Dynamics

16.1 Covid-19 Impact Market Top Trends

16.2 Covid-19 Impact Market Drivers

16.3 Covid-19 Impact Market Challenges

16.4 Porter

Global Blood Purification Equipment Market Segmentation

By Product Type

-

Hemodialysis Devices

-

Blood Filtration Devices

-

Hemoperfusion Devices

-

Continuous Renal Replacement Therapy (CRRT) Systems

-

Plasma Exchange Equipment

By Technology

-

Diffusion-Based Purification

-

Convection-Based Purification

-

Adsorption-Based Purification

By Application

-

Hospitals

-

Medical Centers

-

Dialysis Centers

-

Intensive Care Units (ICUs)

-

Other Healthcare Facilities

By End User

-

Public Hospitals

-

Private Hospitals

-

Specialty Clinics

-

Home Dialysis Providers

Regional Analysis

North America

-

Largest market share driven by high CKD prevalence

-

Strong ICU infrastructure and reimbursement systems

-

Early adoption of CRRT and hemoperfusion technologies

Europe

-

Widespread use of advanced dialysis equipment

-

Strong regulatory emphasis on patient safety

-

Growth supported by aging population

Asia-Pacific

-

Fastest-growing regional market

-

Rising incidence of diabetes and hypertension

-

Rapid expansion of dialysis centers in China, India, and Southeast Asia

South America

-

Gradual growth supported by improving renal care access

-

Increasing government investment in hospital infrastructure

Middle East & Africa

-

Growth led by Gulf countries

-

Rising awareness of renal disease management

-

Expanding private healthcare sector

Competitive Landscape – Key Market Players

The market is moderately consolidated, with competition focused on technology innovation, device efficiency, membrane materials, and clinical performance.

Key players include:

-

Asahi Kasei Medical

-

B. Braun

-

Baxter

-

GE Healthcare

-

Jafron Biomedical

-

Bain Medical

-

Nipro Corporation

-

Fresenius Medical Care

-

Toray Medical

-

Medtronic

-

Guangzhou Enttex Medical Products Industry

-

Kawasumi Laboratories